While not actually part of the account number itself, the check digit is essential to allow easy validation of card numbers and detection of typos, missed digits, etc. is an American multinational financial technology company operating an online payments system in the majority of countries that support online money transfers. The last digit of the card number (the 16th digit in most cases) is the check digit, which is calculated by applying a mathematical formula called the Luhn algorithm to the preceding portions of the account number. These 8 digits are the most important part of the credit card number. In this case, the IIN of 558158 indicates that this card was issued by Paypal in United States.ĭigits 7-15 of the credit card number contain the Primary Account Number, or PAN, issued by the bank to uniquely identify the account holder. This sequence uniquely identifies the bank that issued the card. The first six digits of the card number, inclusive of the MII, are called the IIN (Issuer Identification Number) or BIN (Bank Identification Number).

In this case, the MII of 5 indicates that this is a Mastercard card. The first digit of the card is known as the MII digit, and indicates the credit card's scheme.

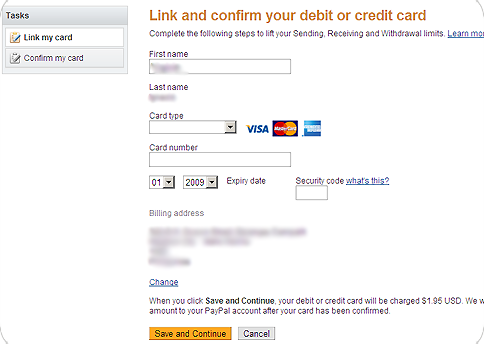

#PAYPAL MASTERCARD VERIFICATION#

While credit card number may seem like a random string of digits, they actually contain a large amount of valuable data about the card that can be used for validation and verification purposes. So if you plan on holding either one of these cards long term, be sure to weigh which one will earn you more cash back based on your spending habits.Anatomy of a Paypal Mastercard Credit Card Number However, after the first year, depending on your spending and preferences, the two cards' rewards may be closer. The $350 welcome bonus and the higher cash-back categories will likely make the Blue Cash Preferred the better card in year one. So if you're deciding between the two cards, it comes down to a simple math equation and your own preference. Please visit /benefitsguide for more details. Eligibility and Benefit level varies by Card. The card comes with perks too like an up to $120 Equinox credit, *rental car insurance and return protection. gas stations, 3% cash back on transit including taxis/rideshare, parking, tolls, trains, buses and moreĪnd the card comes with a valuable welcome offer where you can earn a $350 statement credit after you spend $3,000 in purchases on your new card within the first six months. supermarkets on up to $6,000 per year in purchases (then 1%) When you spend on the card, you will earn: Take advantage of PayPal Payback Rewards and earn on qualifying purchases from select. The Blue Cash Preferred® Card from American Express is a solid pick for a cash back card for your wallet. PayPal Prepaid Mastercard Move money from your PayPal Account. Blue Cash Preferred® Card from American Express If you need to consolidate existing credit card debt, the Citi Double Cash card is also a better choice. These points can then be transferred to airline partners, where you'll often get much more value from your points when redeeming this way. However, if you also have a Citi card that also earns transferrable ThankYou points, like The Citi Premier® Card, you can transfer your cash back from your Citi® Double Cash Card into ThankYou points. So if you're debating between the two cards, the cash-back potential is identical. However, to redeem the cash back you've earned for either a statement credit, cash into your bank account or check in the mail you must have accrued at least $25 in total cash back. After that, your fee will be 5% of each transfer (minimum $5), which is a great way to save on interest charges on revolving credit card debt. The card also offer a valuable intro 0% APR for the first 18 months on balance transfers (15.49% - 25.49% variable thereafter balance transfers must be completed within 4 months of account opening and there's an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. The Citi® Double Cash Card is another great cash-back credit card as it offers an identical 2% cash back on all purchases: 1% on all eligible purchases and an additional 1% after you pay your credit card bill. While the PayPal Cashback Mastercard is a solid pick as a cash back credit card, there are other cards that are potentially more lucrative to consider to help you save on your purchases.

0 kommentar(er)

0 kommentar(er)